Car Variant Car Price Coverage Type Comprehensive Penisular Malaysia Engine Capacitycc and. AIA Malaysia is here to cover your automotive vehicle from unexpected damages with our motor insurance plans through protection for loss theft or accidental damage to your car or motorcycle.

How To Choose The Right Type Of Motor Insurance For Your Needs

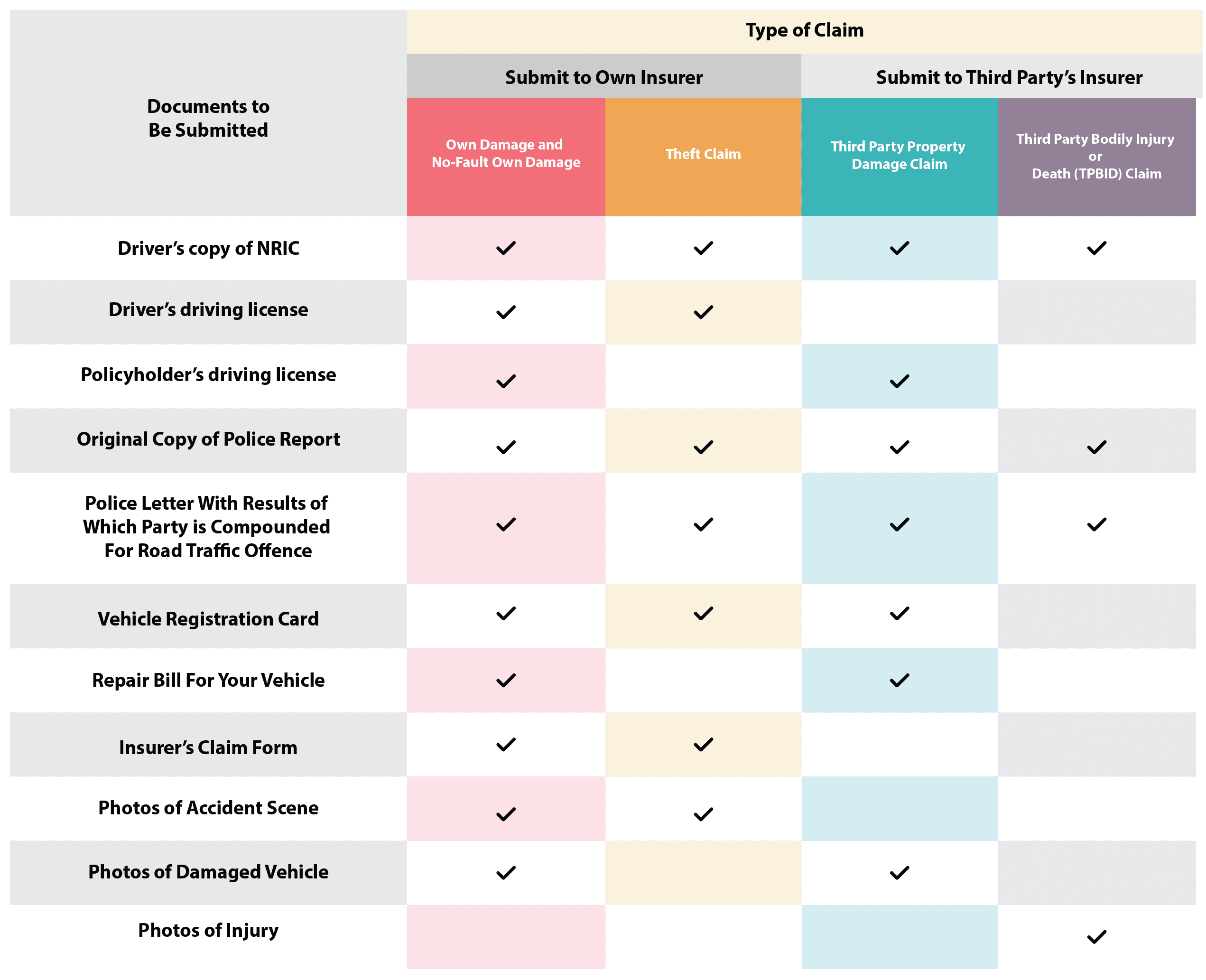

Covers against loss or damage to other parties property.

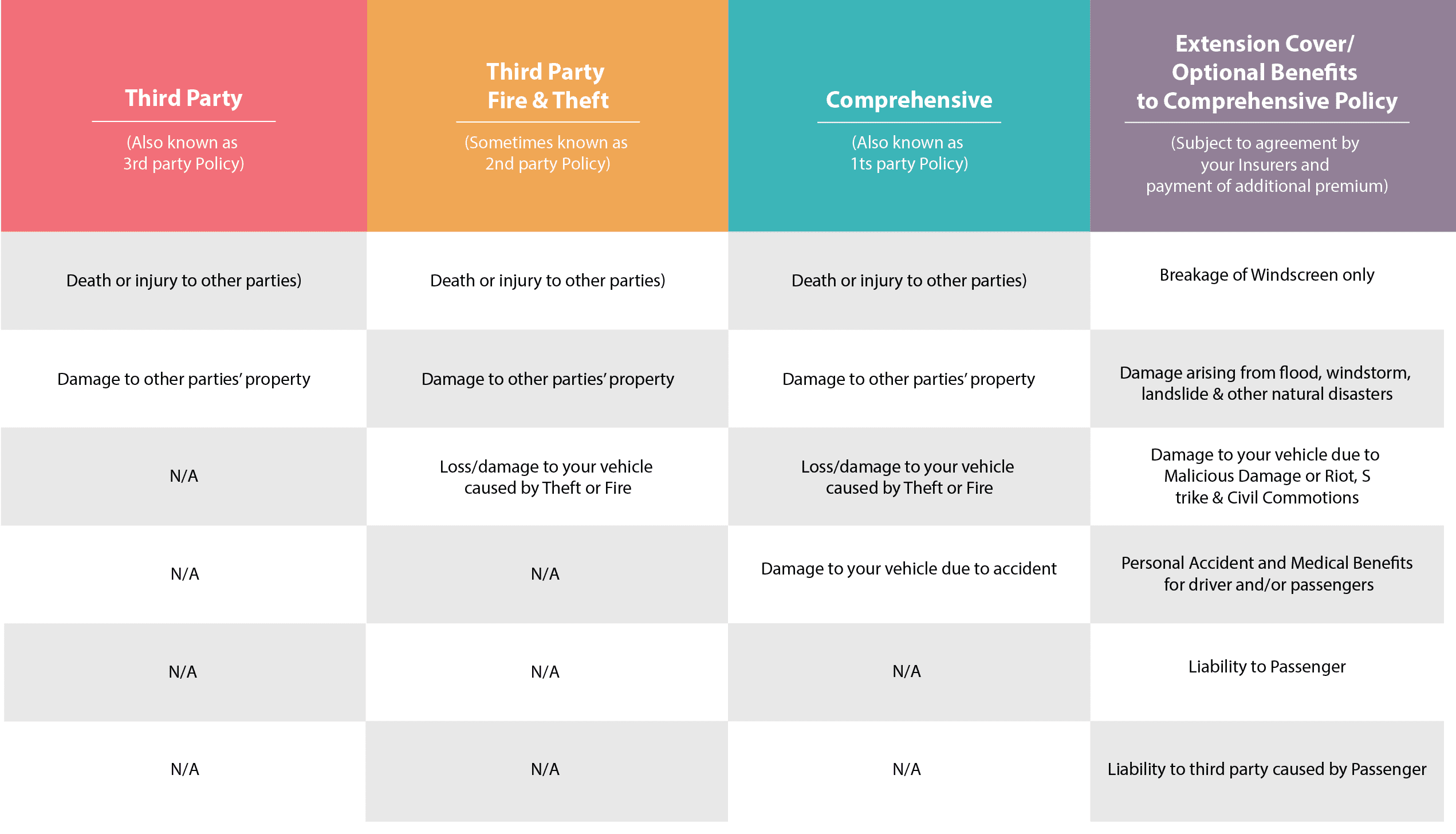

. Life has plenty of journeys. In Malaysia you get to choose from either third party third party fire and theft and comprehensive cover. There are three types of car insurance in Malaysia.

Bjakmy touted as Malaysias leading online auto insurance marketplace. Losses or damages to your car due to accident fire and theft. Each of these policies provides different kinds of coverage.

There are three types of motor insurance policies in Malaysia with varying coverage. Accidental or fire damage to your vehicle. Comprehensive cover third party cover third party fire and theft cover.

Bjakmy Offers Instant Road Tax Renewal Car Insurance. Pays the insuredcovered amount that was agreed at the point of sign-up. To buy and sell new used and reconditioned cars in Malaysia.

As the sum insured for your car is RM50000 you will have to pay 03 of the amount to enjoy the coverage. The car insurance coverage offered by Allianz is one of the most comprehensive covers available in Malaysia. Allianz Motorcycle Plus.

Heres What Malaysians Are Saying. Allianz has been offering its services in Malaysia since 2001. We provide comprehensive protection for you and your car covering you against damage to your own vehicle due to accident fire and theft.

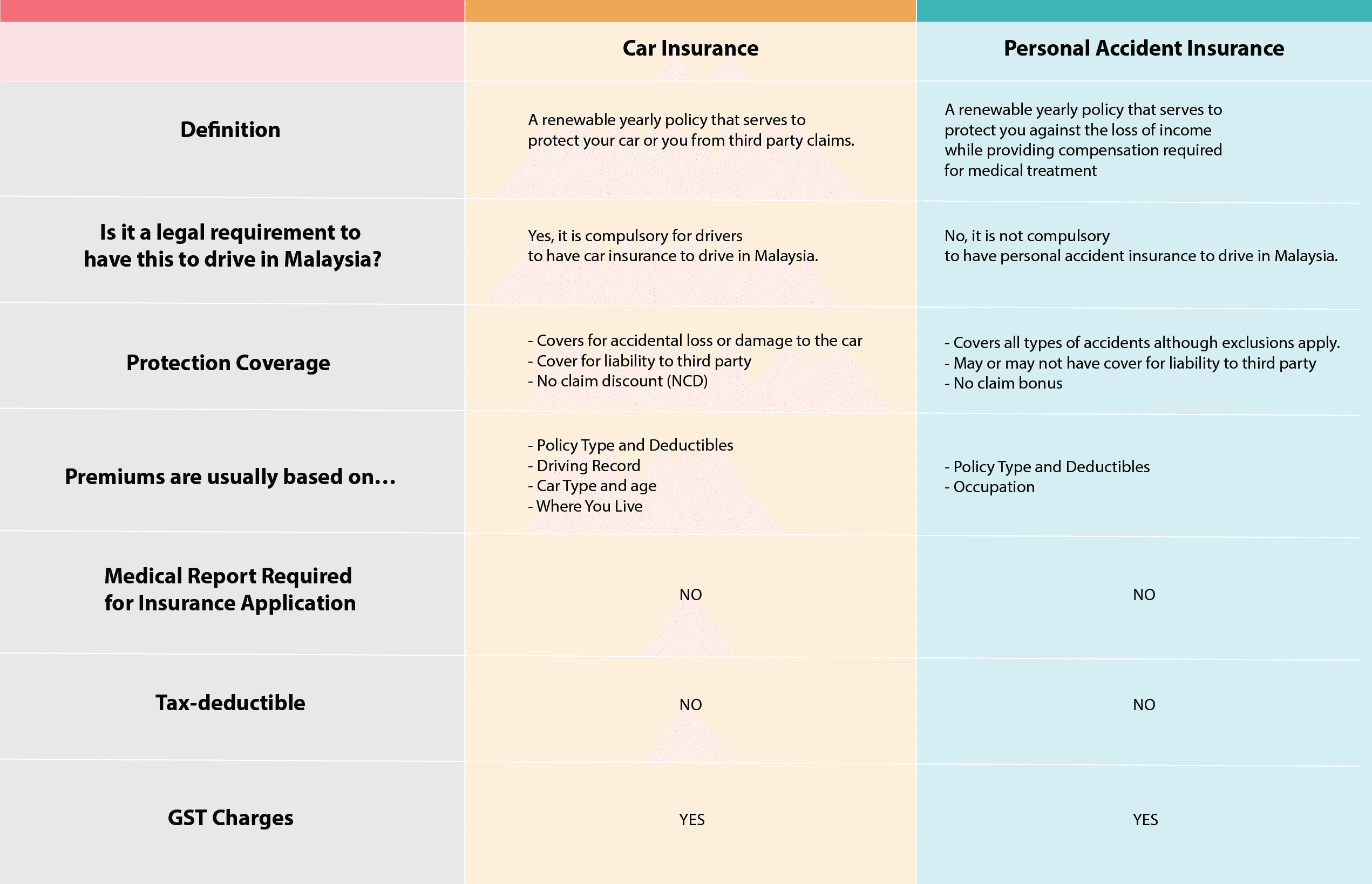

Motor insurance is a compulsory class of insurance for all vehicles licensed to be used on public roads as per the Road Transport Act 1987. Car insurance is compulsory in Malaysia with the minimum requirement being the third-party insurance. All authorised drivers automatically covered.

Liabilities to other parties for injury or death. Enjoy up to 30 cash rebates with the Drive Less Save More add-on. Motor Comprehensive insurance covers your car against liabilities to other parties for death or bodily injuries damages to other parties properties accidental or fire damages to your car and theft of your car.

Covers against liabilities to other parties for death or bodily injuries. Theft of your vehicle. Without a car insurance policy the road tax could not be renewed for your car.

Third Party death and bodily injuries. The price of your premium will first depend on the type of coverage you choose. However this policy doesnt cover you for any damages to your own person or vehicle.

Mazda Insurance Cost List. Check out 2022 Mazda car insurance prices in Malaysia including Mazda insurance package deals Mazda renewal prices Mazda insurance costs and car owner reviews. Yearly Insurance Payment.

Keep those journeys going with AIG Car Insurance - awarded Malaysias Motor Claims Insurer of the Year. Get covered for loss theft or damage to your car and more with optional add-ons for total peace of mind. Get reimbursed with a value you agree with.

Each private car insurance policy in Malaysia allows up to two drivers to be included for free. They sound pretty similar but when you look into the details each of them offers different coverage. Types of Car Insurance in Malaysia.

Lets take a closer look. Get cash of up to RM3000 to replace your lost stolen or damaged car smart key. A third-party cover is usually the cheapest among the three offered car insurance covers and the most basic form of car insurance you can have in Malaysia.

However the premium amount may vary across insurers. Additional benefits for motorcycles below 245cc. It is a plan which covers you for.

Therefore the amount you have to pay is RM150 for a one-year coverage. There are three main. The calculation results are based on the conditions.

If you need some extra guide on how to choose the right car insurance coverage we recommend you checking out this piece we recently did. Best Comprehensive Car Insurance in Malaysia. - New Straits Times.

Type of car insurance. Contact us today for more details. 4 rows It all depends on the type of car insurance coverage you sign up for.

Standard special peril rate for all insurance company is 05 but theres also a limited special peril which cover flood typhoon which is half of it or 025. Its service includes a broad range of insurance products in Malaysia. Say that you would like to get the extensive SRCC cover.

Third party fire and theft. 10 rebate on top of your NCD when you renew online. In effect a maximum of RM40 will allow six different drivers to be named and covered for the 12-month duration of the insurance policy.

There are three main types of car insurance in Malaysia. Third-party fire and theft coverage. Car Insurance Calculator Calculate how much you will have to spend on your car insurance.

AIA Auto Assist Roadside Assist 1-800-88-8733 What matters. The Additional Named Driver add-on allows the inclusion of up to four more drivers for RM10 per person. The premium can cost around 03 of the insured sum.

Get reimbursements of up to RM500 to repair or replace your child car seat s which have been damaged due to accident flood fire or theft of your car. For instance third party car insurance covers only the repair cost of other peoples car involved in. There are three kinds of car insurance policies in Malaysia.

Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. It was a rainy night and youre driving home after a late night at work.

Best Car Insurance In Malaysia 2022 Compare And Buy Online

Flood Damage Coverage For Car Insurance In Malaysia How Much Does It Cost For Special Perils Add On Paultan Org

0 Comments